MAGA Hysteria Reaches Newer, Dumber Heights in Reaction to Harris' Housing Assistance Proposal

Fear mongering armchair economists have come out in droves to "educate" us all

On Friday, August 16, Kamala Harris unveiled some new economic policy proposals in a speech to a North Carolina audience. One of the main features of these proposals that has gotten the most attention is a program to offer $25,000 in down payment assistance for eligible first-time homebuyers.

Although, “unveiled” is not quite right. Note the date on this Xeet: May 17, 2024. Yes, this proposal has been around for a while already, it shouldn’t be today’s major news in the first place. In fact, it was proposed in a bill in 2023, The Downpayment Towards Equity Act. This bill was introduced in Congress in June 2023, and has since languished in committee and gone nowhere. But reporters and the public were too busy with important topics like Joe Biden’s age to think about things like this. But I digress.

Of course, after months and months of bitching and complaining about housing costs, and posting videos of 20-somethings crying in their lattes about not being able to afford basic life and having no future, MAGA is shocked and appalled that Harris would have the audacity to suggest the government give money to these people to help ease their suffering.

What policy proposals have they suggested to help with inflation and housing costs? Well, they are very much in tune with the kids these days and are offering them exactly what they want: anachronistic slogans like “Drill, baby, drill” and general vague treatises about how government spending and debt are the real culprits behind inflation. You know, really brat stuff.

Unsurprisingly, the second this proposal was uttered by Harris, the swarm of vultures arrived to peck at and dissect its innards. And much like the aftermath of a feast such as this, the result is a pile of messy and grotesque organic matter.

Armchair economists

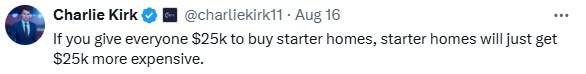

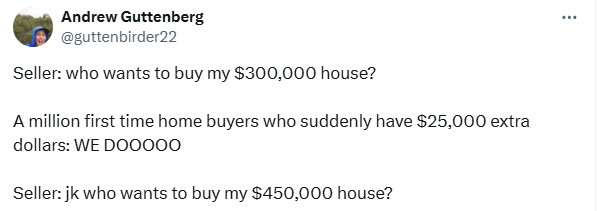

Since every “conservative” is a wannabe economist, they use the tried-and-true method of “counterintuitive unintended consequences” to seem economically educated and belabor their points. Here’s some examples of this tactic being used with this housing assistance proposal:

You get the point. According to these economic geniuses, this $25,000 down payment assistance program would increase home prices by an equivalent $25k at best, and potentially inflate them by as much as 50% at worst. It will ramp up house prices at a time when housing affordability is already through the roof, so it will have an unintended effect—the refuge of the armchair economist.

But even some real economists are jumping on the “assistance amount = price hike” bandwagon. Here’s a quote from a University of Cincinnati economist taken from an ABC News article:

Some economists said the subsidies for homebuyers threaten to undermine the price cuts achieved through additional supply. If prospective buyers know they'll receive a subsidy of $25,000 from the government, they'll boost their asking price by that amount, said [Michael] Jones, of the University of Cincinnati. As a result, he added, home prices will rise.

"If they have $25,000 more to spend on a house, they'll submit bids up to $25,000 higher for the home," Jones said. "That policy in particular is a bad idea because it won't bring the price of housing down."

I doubt this economist has ever bought a home, or if he did, his spouse must have taken care of all the details. But it takes no more than a few seconds to see the absurdity with this statement.

Who decides they will pay overmarket for something just because they have more cash? Think about it: if you are given a large sum of money as a gift, do you suddenly decide to overpay an asking price by the exact amount of the gift? No, you take advantage of having the money and enter the market, but you don’t screw yourself over on the price just because you have that money. You might not negotiate as hard for a lower price, because the purchase of that good is now not as painful with an infusion of cash. But you don’t just say, “I’ll see your $10,000 price and raise you $5,000, because my parents just gave me $5,000”. Maybe that’s how MAGA does its business, but it’s not how most Americans would.

Even a first-time homebuyer is going to try to get the best possible price for their home. They are desperately going to try to keep their mortgage loan amount to the lowest level possible so that the monthly payment is comfortable. The $25,000 assistance just gets them into the market; with this money they can now qualify just to play the game of home-searching. But they are still going to look and see what the asking prices are and work within those parameters for the best possible deal and lowest possible price. They are not going to try to arbitrarily increase the price they would have otherwise gotten.

Sellers will actually be more willing to lower prices

And from the sellers’ perspective, when they put their homes on the market, they don’t know who is buying their home. It could be a cash buyer, or it could be someone that is obtaining 100% financing. At the time of listing their home for sale, they are not aware of the nature or quality of the buyer, so that’s not even a consideration. They are going to list it for whatever price their Realtor realistically thinks it will sell for. They are not going to say, “let’s list our home for $25,000 over market price since some small percentage of buyers entering the market will now have $25,000 in down payment assistance.”

If anything, someone with a larger down payment would get a lower price, as this would mean there’s more chance that the mortgage goes through and the deal closes. An offer with a higher down payment is an attractive situation for a seller, so much so that they are more willing to sell for a lower price. Sellers are entering a transaction like this totally blind as to the real prospects of the success of the buyers’ financing, even if a pre-approval letter is presented. It is understood in the housing industry that the more cash someone has to put down, the better their prospects for successful financing, and therefore the more likely the deal will close without burdensome issues. This is a huge negotiation point for the buyer, and they can and will use it to negotiate the price lower.

The more cash someone has, the more negotiating power they have. All-cash purchases equal faster, easier closings, which sellers are eager to have. Therefore, sellers that are negotiating with all-cash buyers will be willing to trade in a lower price for the ease of a quick, stress-free closing. This willingness to lower the price goes down as the buyer's financing requirements go up. But this willingness still exists, and there is a difference between a $25,000 down payment offer and a $5,000 down payment offer. Far from hiking the price up, buyers with this much more cash will appear more secure for their financing, which will at least keep prices stable, and could actually drive prices down to some degree.

Details Matter

I suppose there is a reasonable argument that if you give everyone $25,000 to buy a home, demand will probably increase, and prices will probably go up, all other things being equal. Okay, I can buy that.

But that’s not what’s happening here. The actual details of the plan, and the complexities of the real world, add many complications to this argument. First, according to the plan, “everyone” is not getting $25k. Not even “millions” are getting $25k. Only a very select group of people is getting this assistance. Here’s some details as outlined in a recent Newsweek article:

[The downpayment assistance plan] would earmark $25,000 in down-payment assistance for 400,000 first-generation home buyers

In addition, an article from Boundless explains:

To qualify, these families must have a history of paying rent on time for at least two years

So this is not even a plan for first-time home buyers as much as first-generation homebuyers, meaning they are the first in their families to have bought a home. And they must meet at least the minimum eligibility guideline of having paid rent on time for two years. This will narrow down the 400k number quite a bit. Not that these folks don’t pay their rent, but just the fact that there’s a two-years-of-rent minimum barrier to entry and the fact that you have to document rent in a way that satisfies mortgage underwriters means that the number will be lower. Plus, in the original bill there were other means-testing eligibility requirements that are likely to make it over into a new bill, and will further reduce the population that can take advantage of this program.

Then you add in the usual logistical problem of just making people aware that this program exists and knowing they can take advantage of it, and you’re not looking at enough people to drive up house prices in general. Tens of thousands, maybe; perhaps a couple hundred thousand. The housing market is currently frozen, it’s the slowest housing market since the mid-1990’s. Higher rates combined with higher prices have shocked the system and created a virtual stalemate. The idea that in this climate prices are going to skyrocket further from this modest level of new demand is ridiculous.

Xenophobia, because of course

And then you have the obligatory MAGA xenophobic reaction:

To the extent that this is even an accusation born of logical thought, and not just a random hit job, this probably references the fact that the first-generation requirement does tend to favor immigrants, as their parents are much less likely to have bought a home in the U.S. But, as usual, the devil’s in the details, and there’s a difference between immigrants and “illegals”.

The people getting this $25,000 benefit for home purchases will still have to qualify for a mortgage to complete the purchase. And “illegals” can’t get mortgages. You have a be a legal resident of the U.S. and have a Social Security Number to even get your foot in the door to be approved for a mortgage. You must be here under a valid visa classification. And mortgage lenders go even further and require that the visa is one where a borrower is likely to be living and working in the U.S. for at least three years. This limits the number of non-citizen residents that can actually qualify for a mortgage.

“Illegal aliens” will not be able to produce documentation of an approved visa, and they won’t be able to verify a social security number. And when you add in the added requirements of needing to verify a two-year history of paying timely rent, plus all the normal requirement of obtaining a mortgage, such as employment verification, etc., you basically have an absolutely invalid concern. People don’t have to worry about “illegal aliens” buying homes in the first place, much less obtaining funds from this down payment assistance program.

Is it possible that “illegal aliens” will take advantage of this program. Yes, technically, if they engage in a very elaborate fraud operation. But committing fraud is not limited to—or even a popular activity of—illegal aliens. It’s well documented that immigrants, documented or not, commit crimes at a lower rate than native born citizens. And rampant “illegal alien” mortgage fraud is not a thing that anyone has ever noted or worried about before.

The old, tired playbook

This is all just a continuation of the old anti-Democrat playbook: hammer home the existence of a crisis, then be aghast when the Democrat proposes a solution, and accuse them of be a communist, socialist, and Marxist, and “explain” why it will have the exact opposite effect than what was intended. This is why MAGA wants Kamala Harris to have a press conference so badly. They want more details they can pick apart, create hysteria about, and “explain” to the us why it’s misguided. Only, the new modern twist is that illegal aliens will be the beneficiaries.

Basically, when you break it down, their stance is that there is no solution, the market needs to work it out for itself, or Trump’s presence in the Lincoln bedroom will somehow fix it. But, of course, they know no one wants to hear that. Especially the Gen-Z crybaby sipping on their latte.

There is a lot more to the plan than the limited subsidy; indeed I'd call the stuff aimed at boosting homebuilding much more important.

https://substack.com/@noahpinion/p-147849831

Amazing how quickly Economists came out of the woodwork professing to be scientists.